Consumers nowadays play a more active role in developing brand experiences

31 May 2023

Photo: HKTDC

In 2021, worldwide retail sales of licensed products reached US$315.5 billion, a record for the brand licensing industry, according to the statistics from Licensing International. As more consumers connect with brands, the industry continues exploring ways to attract consumers into brand experiences through a licensing deal.

During the Asian Licensing Conference (ALC), which took place in Hong Kong from April 19 to 21, 2023, various representatives from the licensing industry – including licensees, licensors, licensing agents and so on – gathered to discuss the trends in the industry and the insights of eminent licensing experts.

Maura Regan, president of Licensing International in New York, shared that the top four jurisdictions in global retail sales in 2021 were the United States, the United Kingdom, Japan and Germany. China was at number five with US$11.945 billion, a 14.5% increase from 2019. China also had the highest growth percentage among the Top 10 jurisdictions, followed by Brazil, which ranked number eight and had a 12.3% increase.

Regan also shared that strong business continued to show in the sectors of entertainment and character licensing, corporate brands, sports and fashion, followed by publishing and collegiate brands.

“For the last five years, entertainment and character licensing remains the strongest part of our business. But overall, there’s room for tremendous growth in other sectors as well because consumer insights dictate to us that consumers are looking for brand experiences in all kinds of formats and brands,” she said.

Photo: HKTDC

Nowadays, licensed products are more than putting cartoon characters on toys or apparel, as the industry has so many creative crossovers to offer. For example, in the sports licensing industry, which has a worldwide sales revenue of US$31.2 billion, licensed products have further evolved from traditional ones, such as sporting goods and apparel printed with sports logos and emblems.

Olivier Ceccaldi, general manager at Infront Sports & Culture in Beijing, a sports marketing agency that serves as the exclusive licensing agent of FIFA in Greater China, said that the

firm tried to adapt and develop a new line of products culturally linked to the Chinese market for the 2022 FIFA World Cup. They created FIFA-themed porcelain tea sets and jade products, such as seals and glasses. Targeting precious metal products is welcomed in not only China but also elsewhere in Asia; Infront created FIFA-themed Chinese Zodiac silver bricks and gold pendants.

“I guess it won’t be a surprise that all the gold products are popular in Qatar,” said Ceccaldi. “The Middle East is very welcoming for this kind of product.”

Ceccaldi shared that his personal favourite is a collaboration product with 1573 National Treasure Cellars, a Chinese brand of local rice liquor known as baijiu. “It’s an experiment,” he said. “Good or bad, I let everybody judge, but it was an interesting co-branded product developed for the World Cup specifically because that kind of product is only in China. I can tell you we produced 36,000 bottles, and everything was sold out.”

Collaboration is an excellent tactic for developing licensed products. Speakers at ALC shared many examples of interesting collaborations of licensed products: Heinz worked with vodka brand Absolut to create a tomato vodka ketchup sauce based on the culinary practice that vodka has been used in pasta dishes in high-end restaurants for quite some time; Jimmy Choo collaborated with Japanese comic Pretty Guardian Sailor Moon to launch a special collection of high-heeled boots, celebrating not just the comic’s 30th anniversary but also their shared values of creativity, individuality and female empowerment; VICTOR Badminton joined hands with Marvel to produce a limited edition of an Iron Man-themed racket and racket bag featuring a powerful superhero in a power-enhancing racket released during the movie launch and immediately sold out. These successful examples are not random crossovers but brilliant pairings of brands that complement each other.

Ben Peace, vice president of APAC at WildBrain CPLG in Singapore, said: “Collaboration adds a huge amount of value. What’s critical is what it means to consumers. Just smashing two different properties together doesn’t necessarily add any value.” He suggested thinking about something that is unique, creates value for both partners and is what the consumer “really wants.”

Moreover, Regan added that collaboration allows each of the partnering brands to bring new consumers into their experience. “It excites and delights both consumers who had a fondness for either brand and now you have consumers who love both in a very different way,” she said. “We’re also seeing from the trend and numbers that it’s not in any way cannibalizing, so it’s not taking away from the sales of one brand or the other, but in fact creating significant incremental revenue around these collaborations, which is exciting.”

Regan explained that consumers nowadays play a more active role in developing these brand experiences. “Back in the day, it was really a top-down experience that, as a licensor, you would dictate pretty much how your brand connected with the consumers,” she said. “What we’ve seen and is accelerated through the pandemic is that the consumer is the front and centre of the brand experience, so the consumer is now looking for those collaborations, those brand extensions. To have that kind of a dialogue with your consumer, I think it’s a huge shift from where it was previously, almost in many ways a monologue. It was a one-

way conversation, from the rights and brand owner to a licensee and consumer. Now the consumer is coming into this much sooner.”

In addition to physical products for retail sales, another rising trend in the licensing industry is location-based experiences (LBE).

Contrary to the prediction that online experience is going to take over and replace brick-and-mortar experiences, there is tremendous growth in all kinds of in-real-life experiences, which take place in theme parks, shopping malls, pop-up stores, restaurants, cruise ships, hotels, etc., and allow consumers to experience the brands on so many levels, ranging from attending an event or a live show and visiting an attraction to purchasing from an affiliated souvenir shop.

According to Regan, statistics show that by 2028 LBE is forecast to reach US$30.2 billion based on a 34.4% annual growth rate. “Clearly, if you’re a brand owner or rights owner, then looking at these kinds of experiences is a way to extend your brand,” she said.

Many speakers at ALC are experts at LBE, and they shared their success stories of using LBE to increase foot traffic, marketing reach and sales revenue – Harbour City, a shopping mall in Hong Kong, worked with Pixar to turn its entire venue into a Toy Story-themed carnival space with 16 checkpoints scattered around the mall, including its tenants, drawing visitors into the mall while promoting the movie launch; a touring exhibition of the Japanese cartoon Doraemon, which displayed 100 life-sized figures of the robot cat, each carrying a future gadget originated from the series, was staged in 10 cities in China, including Shanghai, Guangzhou and Beijing, where concurrent retail sales of licensed goods reached Rmb18 million (US$2.52 million) over 45 days; Monopoly Dreams, the world’s first themed attraction based on and licensed by the classic board game, was established in Hong Kong as a tourist attraction and is planning to open a second attraction at Melbourne in the latter half of 2023.

Nevertheless, Regan said that despite the rising popularity of in-real-life experiences, online is certainly not going away. “Anytime that we’re able to have an experience in real life, in person, it only supports and enhances that online experience,” she added.

Apart from the brands, types of products and formats of experiences that can attract them, the experts suggested that consumers nowadays also have higher expectations of their brand value and how they run their business.

“Sustainability continues to remain at the forefront of decision-making for most businesses worldwide,” said Regan, explaining that it’s no longer a marketing stunt but an essential part of business development. “Consumers are demanding that there’s transparency and commitment to creating products that are not only good and enjoyable for the consumer’s experience but also good for the planet.”

Andrew Kwan, executive vice president at Maxx Group in Hong Kong, suggested companies make their licensing business more sustainable. “As a potential licensee, we can focus on designing and developing socially and environmentally sustainable products and services. In doing so, we can also look at what corporate IP or entertainment IP we can consider that

helps us elevate the brand awareness of these specific socially or environmentally centric products and services,” he said.

For brands that do not have a good awareness yet, he advised leveraging global or local brands to help them create or enhance brand awareness by associating with better-known brands. For licensors and brand owners, Kwan suggested a sustainability discount on the royalty rate offered to licensees that have genuinely sustainable products or services. They may also consider low to no minimum guarantee and extended terms to allow the licensees to recruit the investment over longer durations.

Furthermore, he said licensors offer support in marketing and promotions, such as featuring these sustainable products on their ecommerce page and working with retail partners to promote them and broadcast these products on a much broader scale.

Kwan also had some suggestions for licensing agents. “Purposefully seek out products and services that have sustainable-centric thinking. Lower our commission requirements, and by doing that, hopefully remove or reduce the hurdles for the licensors that may decide to lower their commercial requirement. And perhaps, coordinate with the licensors to educate the public why sometimes it’s a bit high price that makes better sense for our future.”

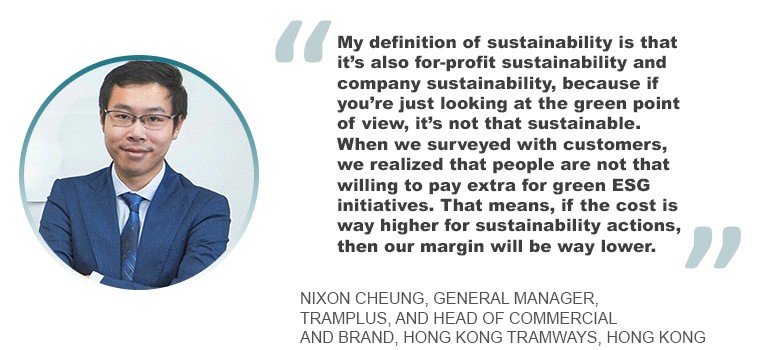

“This isn’t going to be easy because everybody has to take a cut,” admitted Kwan. On the other hand, Nixon Cheung, general manager at tramplus and head of commercial and brand, Hong Kong Tramways, offered a realistic point of view about sustainability and profitability, suggesting that sustainability is not just limited to the conventional concept of protecting the environment and social well-being.

“My definition of sustainability is that it’s also for-profit sustainability and company sustainability. Because if you’re just looking at the green point of view, it’s not that sustainable,” he said. “When we surveyed customers, we realized that people are not that willing to pay extra for green ESG initiatives. That means, if the cost is way higher for sustainability actions, then our margin will be way lower.”

Instead of focusing on ESG sustainability, Cheung advised that companies should find ways to balance it with business sustainability.

In addition to eco-friendliness, consumers demand that the licensed products they buy are ethically-produced too. Thus, social compliance is another important aspect that companies should pay attention to.

Paul Murawski, director of marketing and trademark licensing at Yale University, shared his relevant experience: “All our licensees are required to participate in the Fair Labor Association (FLA) and adopt their Code of Conduct, or be members of the Ethical Trade Initiative (ETI) and adopt their Base Code.”

While FLA pertains more to the US market, many of Yale’s licensees belong to ETI for Europe and Asia. The Workplace Code of Conduct of FLA defines the labour standards and humane working conditions that are internationally accepted, whereas the Base Code of ETI is founded on the conventions of the International Labor Organization and is internationally-

recognized as a code of conduct. With these requirements, the university can ensure social compliance among its licensees.

“It promotes fair and equitable working conditions globally, and also, it’s important to sustain jobs throughout our supply chain,” said Murawski. “It’s the highest quality collegiate licensed products, produced under the highest ethical standards.”

To sum up, an important piece of advice the speakers share is to truly understand what the consumers want.

“Licensing is always driven by consumer experiences,” Regan said. “While the common analogy is that necessity is the mother of invention in licensing, it proves the case that invention is the mother of necessity. We didn’t know that we needed to have it until we saw it, and that’s always brought to you by a licensing deal.”

- Ivy Choi